Thank you for registering with Bright Sky

Below you will find confirmation of the nature of your engagement as discussed on your onboarding call. We will also require documentation and ID verification from you before your registration is finalised and you are fully set up and ready for payment.

All of the information you need can be found on this page, please use the buttons on the right to move between the sections.

Let’s recap

You have confirmed you are working on a self-employed basis and you will be engaged by Bright Sky as self-employed on a Contract for Services. When working under the CIS scheme your UTR must be verified with HMRC. Verification confirms the level of tax Bright Sky must deduct on each payment made to you.

The deduction levels are:

- Higher – 30%

- Standard – 20%

- Gross – 0%

Bright Sky cannot determine your deduction level this is provided by HMRC and any requests to change deduction level must be done directly with HMRC.

Deductions taken are considered at the end of the tax year and any overpayment will be returned to you via your self-assessment.

There will be occasions where depending on your overall circumstances in a tax year there could be a tax liability and therefore it is advisable to plan for this and ensure you save an amount towards any potential liability. You can contact our office for more tailored advice with regards to yearend tax liabilities and/or refunds.

The tax year runs from 6th April to 5th April each year so please retain copies of your remittances to assist you in completing the yearend return – don’t worry if you lose any as you can always download all your remittances from your online portal.

Bright Sky do offer a tax return service from £125+VAT so please let us know if you require any assistance.

Your circumstances are likely to change as you move from one assignment to another which could impact the way in which you are engaged. We will review this throughout the year however if at any point your job role, assignment or agency change please notify us at your earliest convenience.

As a self-employed worker it is your responsibility to ensure all taxes due are paid on time and you have no employee statutory rights. The only deduction taken by Bright Sky is your company margin as detailed on your remittance. Before payment you will be provided with a Contract for Services to review, sign and return.

You are required to hold your own insurance of which a copy may be required.

VERIFYING YOUR ID AND CONFIRMING YOUR RIGHT TO WORK

Bright Sky Umbrella is responsible and liable for ensuring right to work checks are completed in line with Home Office guidance. Your Bright Sky advisor will have confirmed the ID type required from you along with where and how to submit this.

If you have not received a separate email confirming your ID requirements, or wish to check your submission has been approved in order to ensure you are fully registered for payment, please contact the office on 0151 433 7333 or registrations@brightskyumbrella.co.uk

Contract

You will receive an email from R Sign advising you have a document to review and sign.

Click the yellow box to access the document

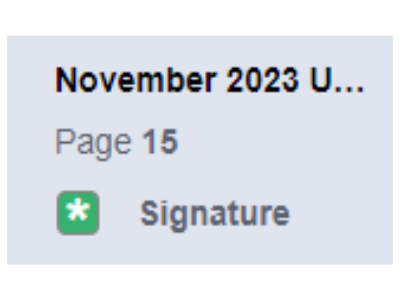

On the left hand side you will see the pages that require a signature

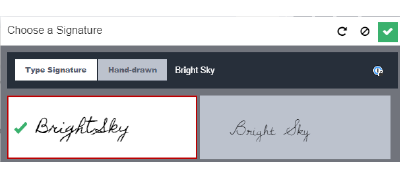

When you click into the signature box on the left a box will appear that asks you to type or handwrite your signature. Click the green tick box to confirm the option you have chosen

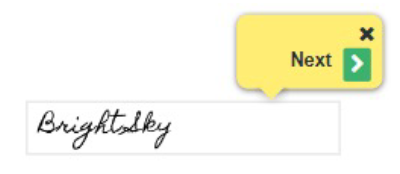

Clicking next will take you to the next required signature page

Continue clicking the green next arrow until you are happy that all signatures have been applied

Send the completed document back to us by clicking the green icon in the top right corner

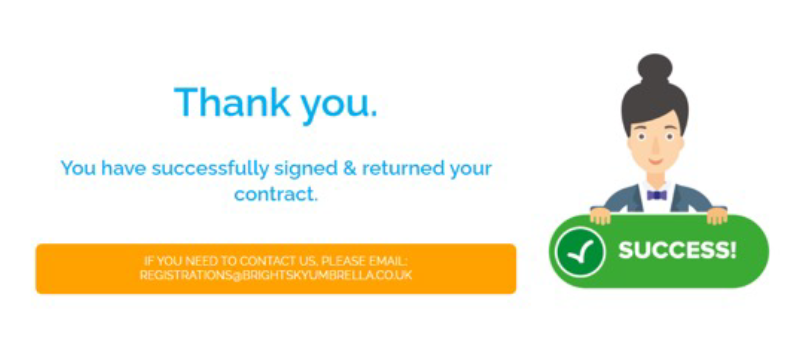

When you have successfully submitted the contract you will be taken to our landing page

If you have any issues completing the above please call the office on 0151 433 7333 to allow us to assist you as quickly as possible.

Your online portal

Whether you want to view your remittances, upload your ID, view your contract or simply contact the Team at Bright Sky this can all be done online and hassle free.

How do I register for the online portal?

When you first register with Bright Sky you will be sent an activation email. This will give you a link to activate your online account and set a password.

- Make a note of your username – usually first name.surname

- Set your password

If you need another activation link sending please contact the team and we will be happy to resend this for you (Please check your junk folder as it may be in there).

How do I log into my Bright Sky portal?

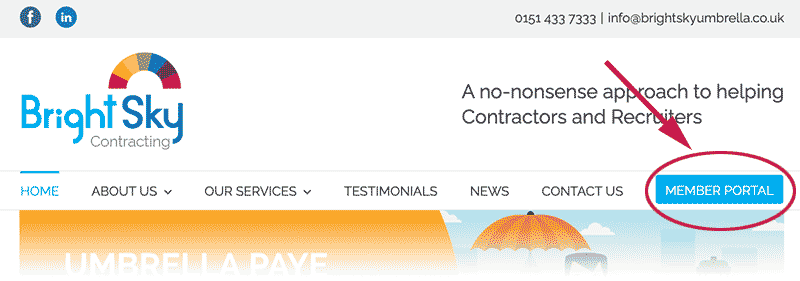

Open your internet browser and enter the below web page: https://www.brightskycontracting.co.uk

Click where it says ‘MEMBER PORTAL’ on the right-hand side.

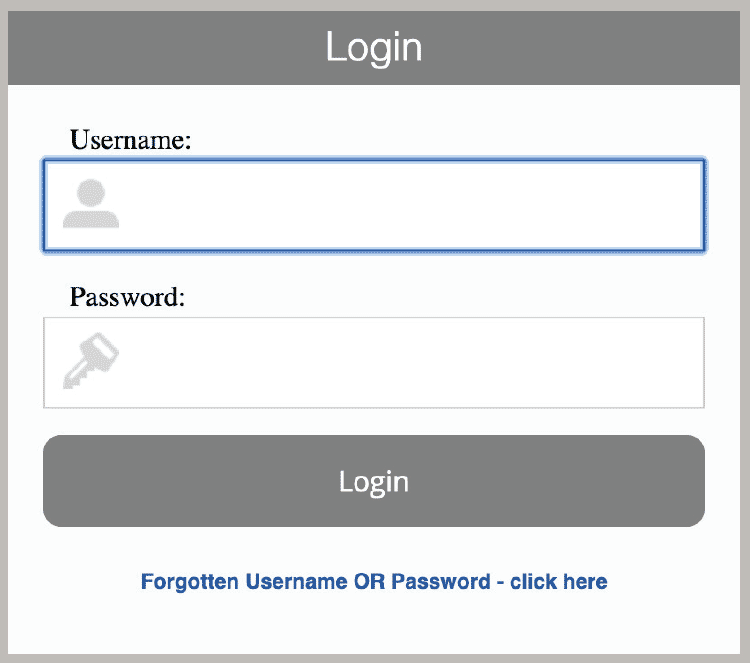

Once you have clicked on ‘MEMBER PORTAL’ this screen will come up where you will need to enter your Username and Password.

Once you have logged in you will be taken to your home page where you can:

- View Payslips

- P60’s – Only apply to employee’s (Umbrella)

- Pension Notifications – Only apply to employee’s (Umbrella)

- Messaging

- Document Upload and Approval

If you have not yet activated your online portal log in, please contact us on 0151 433 7333 or email info@brightskyumbrella.co.uk and we can send you a new activation link.

If you are logging in using your mobile phone you can select this item at the bottom of the screen to view in app format:

Then select the options if your phone does not automatically reformat when you log in:

General information

Once we have verified your right to work documents and received your contract you are engaged for commencement of work or fully registered for payment.

We receive the confirmed hours due to be paid to you from your agency. These are processed through our system and you are issued with you remittance advice by email as well as via the online portal. You will also be sent an SMS notification of the NET amount to be paid into your bank account.

If you have any queries with your hours please contact Bright Sky on 0151 433 7333 or payroll@brightskyumbrella.co.uk and we can look into this for you.

Your payment will usually clear before 9am on a Friday.

If you require copies, these can be found on your online portal and downloaded.

Additional information

To read our GDPR info, please click the button below:

To read our GDPR policy, please click the button below:

To read our Data Protection Policy, please click the button below:

To read our Complaints Policy and Procedure, please click the button below:

Key Information Document (KID)

The Conduct Employment Agencies and Employment Regulations 2019 go a step further than previous legislation set out in the 2003 Regulations and shines a spotlight on workers having a full understanding before the commencement of their engagement.

Any worker engaging with a new agency or where any significant changes to assignment occur will need to be provided with a Key Information Document (KID) to provide a clear outline of how they will be engaged and explaining a full breakdown from contract rate to net take home pay.

The KID provides greater transparency for the workers about the terms they are signing up to and will minimise any confusion prior to the beginning of an assignment. Bright Sky can assist you in providing a KID for you to include within your new joiner information pack and we have provided further details below: